Conducting Clinical Studies in Romania and Bulgaria

Why choose Romania and Bulgaria?

Romania and Bulgaria are home to highly competitive cost solutions per patient, a unique epidemiological profile leading to a wide range of therapeutic indications, a wide availability of naïve patients, experienced researchers and highly educated health professionals working under regulatory and protocol compliance with good-quality data proved by audits and regulatory inspections, highly concentrated and specialized healthcare service, smooth regulatory pathways following EU regulations and supportive infrastructure.

Population ( potential patient pool )

According to Eurostat1 together the two countries share a population of 27.5 million people, the largest country being Romania with almost 20 million inhabitants followed by Bulgaria with 7.5 million residents.

Regional economy & health care system opportunities

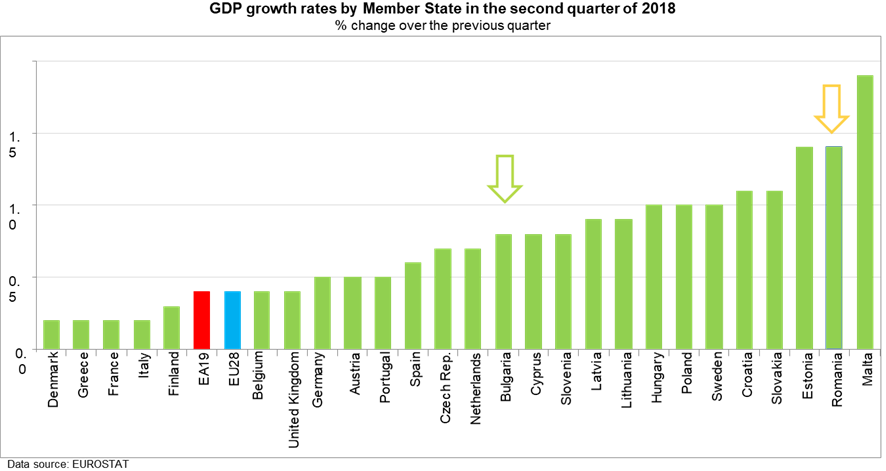

Both countries belong to EU and NATO, have stable and fast developing economies,

enjoying some of the highest GDP growth rates in the EU :

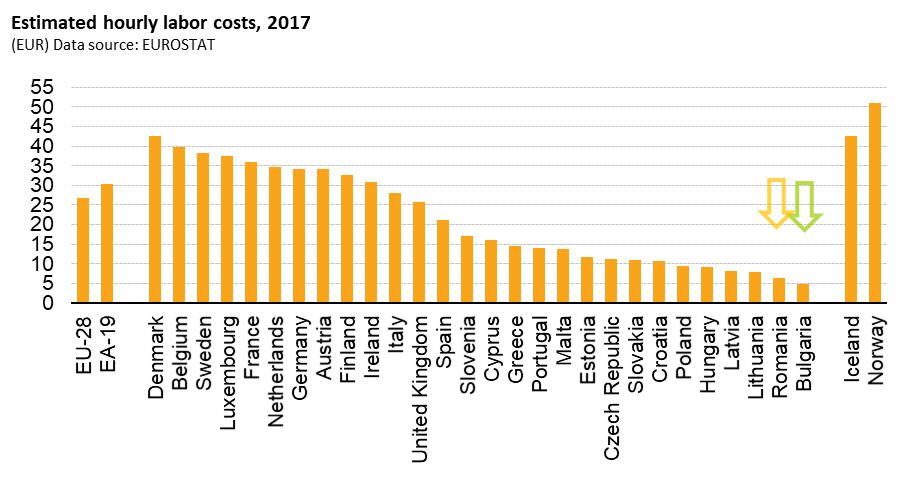

What makes both countries extremely cost attractive for clinical trials is that their labor cost which is just a fraction of Western European countries, having the lowest GDP per capita rates in the EU.

Salaries in the healthcare sector are incredibly low in comparison with their Western correspondents. Also the monitoring cost is naturally lower than those of Western Europe, the monitoring costs level amounting around 50 – 70 % of their correspondent Western EU level, while the investigator & hospital fees always stay meaningful lower as compared to Western EU standards. Other additional accountable costs, such as travel, accommodation and postage are considerably lessened. The bottom-end is a highly competitive cost per patient in Bulgaria and Romania.

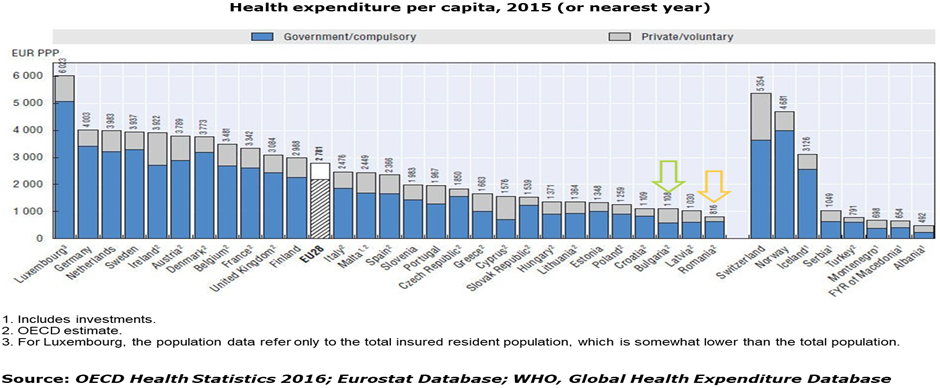

In terms of healthcare system both countries follow a similar path, their healthcare systems are critically under budgeted while patients have to share an important burden of local healthcare expenditure directly out of their pockets, drifting to poor availability of curative means and a high percentage of treatment-naïve patients:

- Health Spending per capita is the lowest among EU countries:

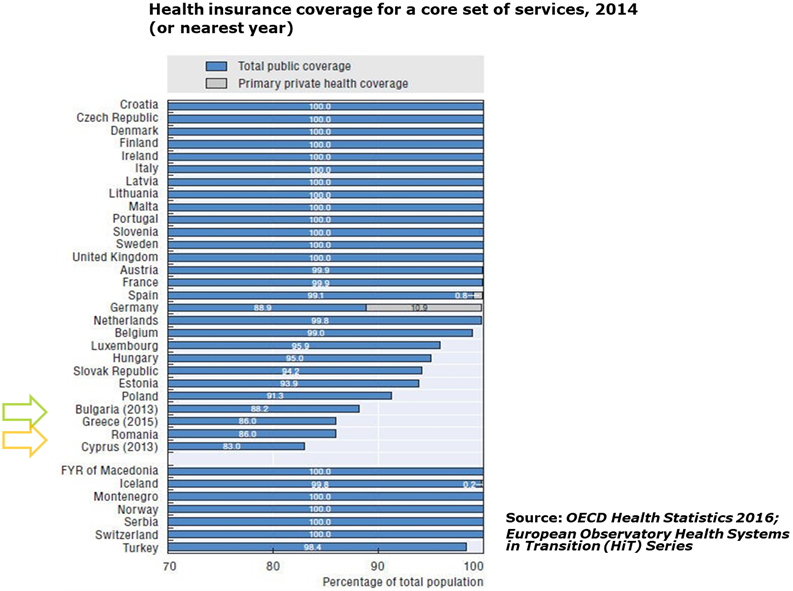

- In terms of health coverage Romania and Bulgaria have a large coverage gap versus the Western European countries:

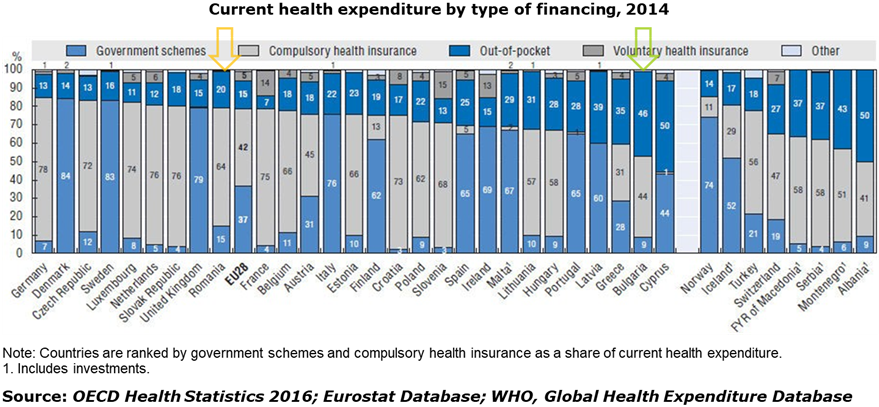

- Direct out-of-pocket payments represent a large stake of the health spending especially in Bulgaria:

Therefore all Clinical Trial Programs in Romania and Bulgaria are offering ethic therapeutic means to local patients, meanwhile representing an alternative (sometimes the only) option for patients to have access to innovative, new-generation molecules and medical devices.

The epidemiologicalprofile of both countries share similar challenges and offers a direct input regarding the clinical trial opportunities within a wide range of therapeutic indications:

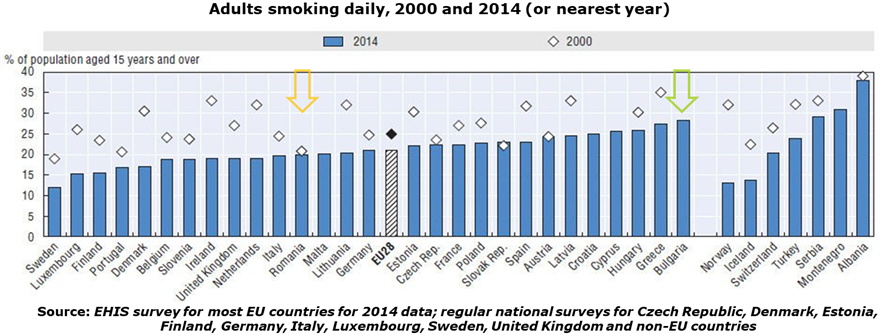

- Smoking among Bulgarian adults it’s way above EU average :

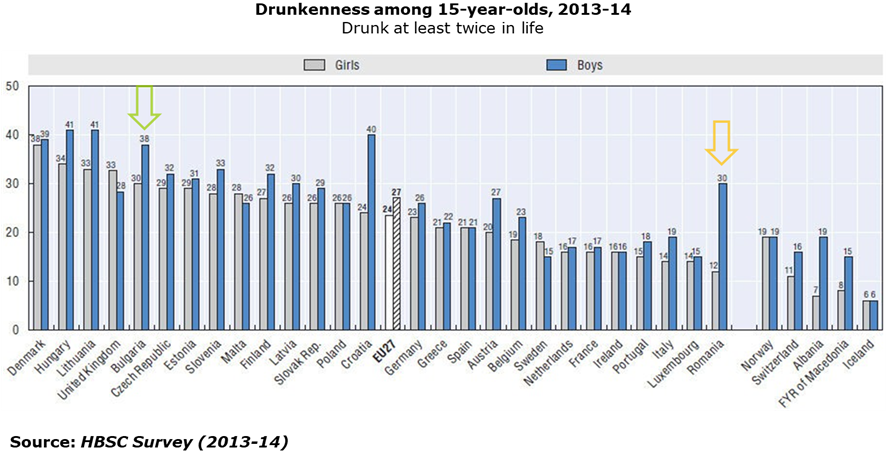

- One out of three adolescents across Romanian and Bulgaria report having being drunk at least twice in their life:

- Regular heavy alcohol drinking is a big problem in both countries :

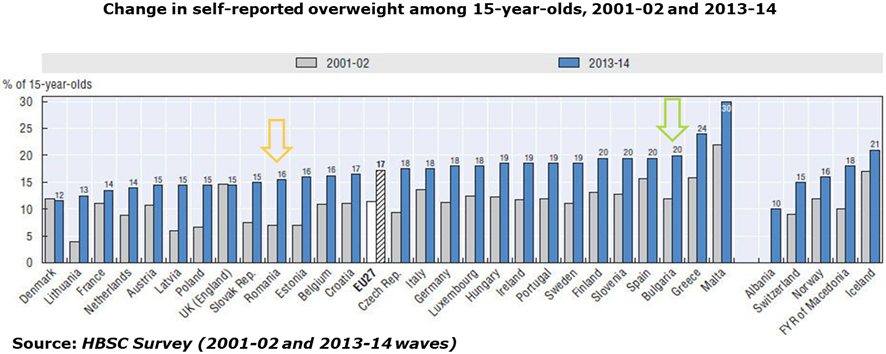

- Obesity among juvenile population has grown up significantly over a decade:

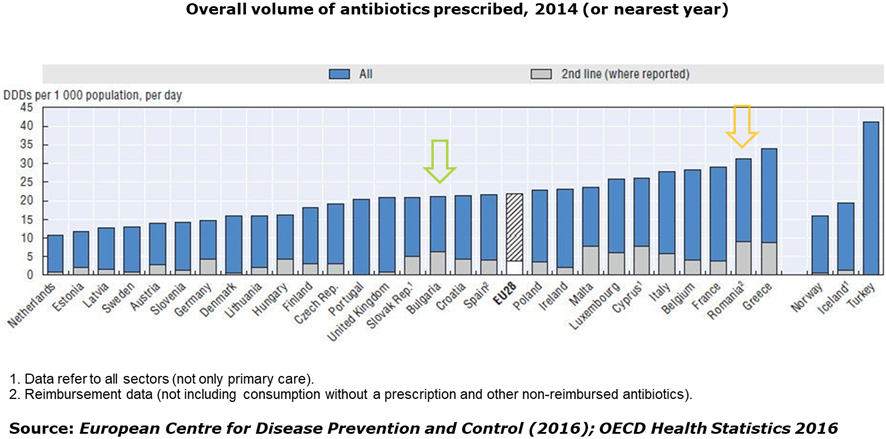

- Too many antibiotics are prescribed, particularly in Romania:

Regulatory Environment

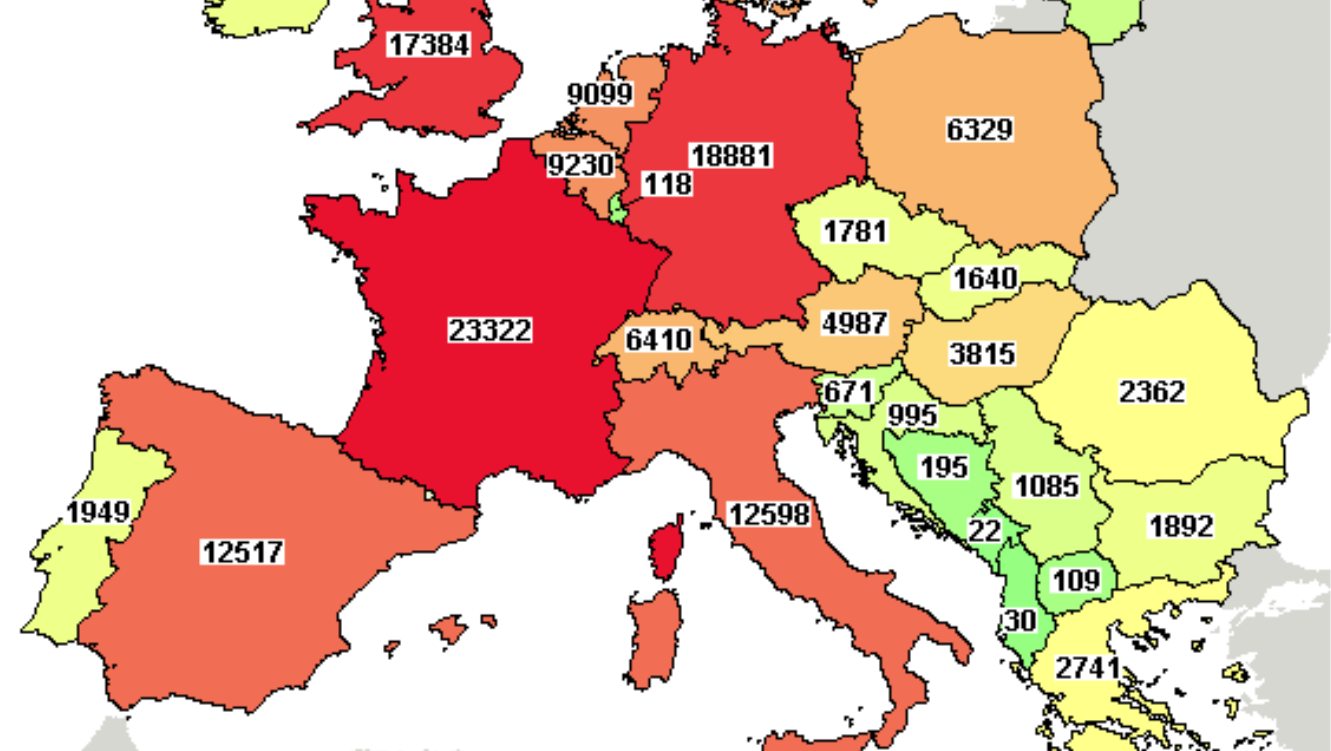

Regulatory and legislative reforms follow EU accession, both Romania and Bulgaria have adopted and fully implemented the EU Clinical Trials Directives. Trial start-uptimes and requirements are comparable with other EU countries: it takes in average 60 days since submission to obtain CA and CEC approvals, the regulatory environment being one of the principal reasons behind the important figures of completed and active studies in both countries in 2018 2.

CECs work is slightly different in Romania and Bulgaria:

- Romania: For IMP studies with multiple sites there is a centralized EC to be addressed, yet if a single site is involved only LEC approval could be obtained. For MD studies only LECs could be involved.

- Bulgaria: IMPs and MDs follow the same path, meaning a centralized EC is designated for study submission

In both countries some (but not all) sites ask for LECs approval is much formal.

The start-up process depends on the duration of contract negotiation between sponsor and study sites and the process is slightly different in the two countries:

- Bulgaria: CEC/CA asks for contracts drafts, but the management of some sites need to see the contract drafts first in order to release some documents for CA so , depending on site, contracts are not a burden but it is good to have them ready upfront at least 45 days prior to CEC/CA submission

- Romania a single fully executed CTA is needed (out of all the sites subject to CEC submission) while the remaining CTAs should be submitted fully executed forms no later than 45 days post NEC submission, therefore contracts should be ready for site negotiations 30 days prior to NEC submission in order to speed up the approval process

Quality:

There is an abundance of high quality investigational sites in Romania and Bulgaria because the number of teaching hospitals, university clinics and postgraduate medical schools is high. There is a well established very high standard of medical education, there are 17 medical university schools in Romania and 5 medical schools in Bulgaria, while the number of university clinics stands for 39 units in Romania and 15 in Bulgaria, with similar infrastructure and state of the art diagnostic capabilities meeting the western standards. More practitioners are employed by teaching hospitals and university clinics compared to Western Europe average. GCP guidelines are fully implemented, the GCP training of the investigators is compulsory required by the regulatory authorities in both countries, while GCP refresher is required every second year for all study team members. The overall good regulatory and protocol compliance with good-quality data (comparable to Western Europe and the US) is certified by -audits and inspections.

High recruitment rate:

There are several particularities of the healthcare system that constantly translates in high recruitment rates throughout the region:

- Shortage of available therapy as the national therapy and reimbursement programs are not able to meet the local needs

- The insufficient availability (sometimes the total lack) of preventive medicine

- A wide availability of naive patients

- A large heterogeneous patient population

- Availability of multi-specialty medical institutions with highly educated medical personneland specialized healthcare services

- Patient willingness to participate in clinical trials sponsored by Western companies, patient retention if very good

- Investigators are motivated to take part in clinical trials and perform well, as they largely acknowledge that co-operating with Western pharmaceutical companies in scientific research is a sign of academic distinction, merit, and prestige while the investigator fees comfortably rounds-up their earnings

- Over 90% of site staff are speaking English, including study nurses

Logistics and communication:

Our synergic operations and local know-how covering Romania and Bulgaria facilitates your access to highly specialized & fully trained ICH-GCP investigators that have a vast experience in running clinical trials .The site staff (English-speaking investigators in a dense network of healthcare facilities) makes a great deal of efforts to ensure the studies are run according to the protocol and in line with local and international regulations. The guidance provided by CRO’s and sponsors is largely accepted and there is a refreshing willingness to learn and improve practice.

AICROS, the alliance of International CROs, is a network of local & well established CROs businesses providing full range clinical research services on a global scale. If you are planning your Clinical Trial in Romania and Bulgaria or need local help AICROS team is here to help. Call +4917621065564 or email us on info@aicros.com

REFERENCES:

- //ec.europa.eu/CensusHub2/query.do?step=selectHyperCube&qhc=false

2 //clinicaltrials.gov/ct2/search/map?map=EU, data source 30 September 2019

DISCLAIMER:

This document reflects the opinion of AICROS on the date of publication and subject to the available information, and may be modified at any time. The information, analyses and opinions presented are drawn from multiple sources that were judged reliable and credible. However, AICROS does not guarantee the accuracy, completeness or representativeness of the data contained in this document. The information, analyses and opinions are provided for information only and should be used in conjunction with other information the reader might already possess. AICROS is not bound by an obligation of results but by an obligation of means and shall not be held responsible for any losses incurred by the reader arising from the use of the information, analyses and opinions contained in this document. This document, and likewise, the analyses and opinions which are expressed are the sole property of AICROS. The reader may consult or reproduce them for internal use only and subject to mentioning AICROS as the source; the data may not be altered or modified in any way. The information may not be used, extracted or reproduced for public or commercial purposes without prior permission from AICROS.

30 September 2019Copyright © AICROS. All rights reserved.